Real estate market, falling volumes and selective dynamics

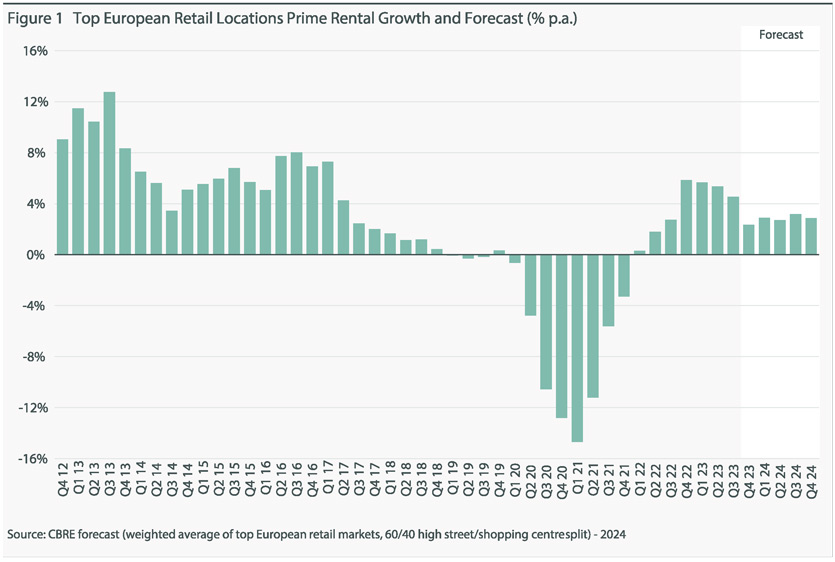

(February 2024) | In a highly selective real estate market characterised by stable or falling prices, the most promising growth prospects are to be found in the residential and logistics segments. The logistics sector is benefiting from steady growth in e-commerce and the demand for properties located close to urban centres, or even inside the urban perimeter in the case of large cities. Datacentres offer better prospects than offices or traditional brick-and-mortar stores, especially smaller premises which are struggling in the face of reduced interest and falling retail prices. Early forecasts by real estate analysts for the upcoming year anticipate a more accessible market in Europe, supported by gradually decreasing mortgage rates and declining residential property prices. Following a modest fall in prices across most European countries in 2023, the trend is expected to persist in some countries until 2024 with little or no prospect of a robust recovery until 2025.

According to analysts from S&P, house prices and investments will be significantly impacted by the rapid increase in mortgage rates, and it will take some time for market prices and investments to fully adjust to these higher interest rates. The duration of this adaptation period will vary across countries, in some cases potentially lasting up to ten quarters. Notably, the sector is seeing the emergence of a number of niche areas such as renewable energy infrastructure, driven by growing interest in battery storage, solar farms and car parks equipped with electric vehicle charging stations. This trend reflects a broader shift towards investments in social infrastructure, expected to attract substantial capital expenditure in the coming years.

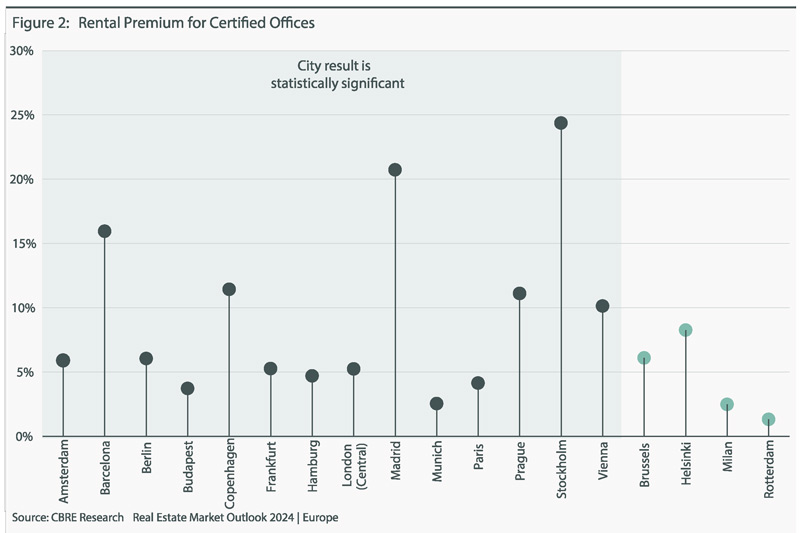

The European real estate market experienced a downturn in 2023, with Italy, France, Germany, Spain and the UK collectively reporting just over €900 billion in sales and a 1.2% decline in real estate revenues compared to 2022. The European real estate market has entered a cyclical downturn marked by continuing high inflation (by the standards of the last 20 years) and rising interest rates. According to the PWC/ULI report entitled Emerging Trends in European Real Estate Markets, this economic environment is prompting investors to review their strategies and adopt a cautious, wait-and-see approach. Macroeconomic and geopolitical uncertainties remain the biggest risk factors, including recession risk in major economies such as Germany and the UK, while sustainability and compliance with ESG criteria are at the top of market players’ agendas. The challenge is to adapt existing buildings, and public players will have to implement strategies capable of meeting evolving needs in the coming years.

Residential and logistics will be the real estate sectors to focus on in 2024. According to Alex Jeffrey, chief executive of Savills Im, “2024 will likely prove to be another challenging year for real estate investors. However, periods of high market stress will present opportunities to those investors with the requisite market knowledge. We see allocators tilting towards Living and Industrial & Logistics orientated strategies.” Modern asset creation to meet user needs is expected to drive significant volumes of new public and private investment. Although the residential rental market has traditionally been the preserve of private investors, the favourable underlying dynamics are now also making the sector attractive to institutional players. According to analysts at BNP Paribas REIM, rents may increase by 18% in the Netherlands, 15.5% in the UK, 13.5% in Spain, 10.5% in Italy, 9% in France and 7% in Germany.

But it is the logistics sector that promises particularly favourable returns. According to Savills Im, rents in key logistics locations will continue to grow in 2024. Vacancy rates are almost zero and the existing stock is relatively old, resulting in enormous potential for modern, efficient, sustainable and well-located real estate. The logistics sector, urban logistics in particular, continues to see a growing demand for modern, sustainable and efficient space, which coupled with ageing infrastructure creates significant development opportunities for investors.

According to the latest RE/MAX National Housing Report, the real estate market in the USA experienced a slowdown in the fourth quarter of 2023, while 2024 presents opportunities for a recovery that may positively influence buyers and sellers. Clarion Partners is cautiously optimistic about the real estate market 2024 and believes that current market conditions may allow for attractive buying opportunities over the coming 12-18 months.

Country Garden, China’s largest private real estate developer, expects the country’s real estate market to remain weak in 2024, while the ten largest investment banks, including Goldman Sachs, Morgan Stanley and UBS, anticipate a further decline in the Chinese housing market throughout the year. In addition, the High Court of the Hong Kong Special Administrative Region (HKSAR) issued an order to liquidate the property giant Evergrande at the end of January. The company was in the process of preparing a new debt restructuring plan after facing a liquidation request and legal action from foreign creditors over a number of missed payments. The Hong Kong stock exchange-listed property giant is the most heavily indebted property developer in the world, with the equivalent of more than US $300 billion in debt. The liquidation is likely to further undermine confidence in China’s struggling real estate market and cause turbulence in the stock market, which the government has once again recently sought to stabilise.

(cover image by jannoon028 | Freepik)