Market Economics

A rollercoaster ride for the global construction industry | by Francesca Iori

The world construction market and ceramic tile sector are seeing divergent trends, driven by factors that vary according to the different markets and competitive scenarios.

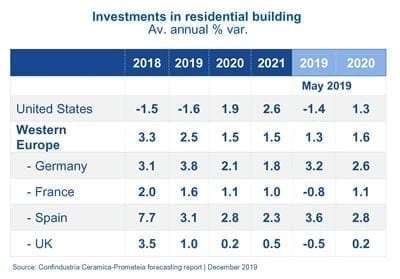

The US residential construction sector is expected to recover gradually in 2020-2021 on the back of the anticipated upturn in Canada and the US coupled with more favourable financing conditions. With Chinese export market shares hit by import duties, Italian exports will have a chance to resume growth, albeit more slowly than their main competitors. As a result, Italian market share is expected to return to 8% with direct export flows reaching about 3 million square metres.

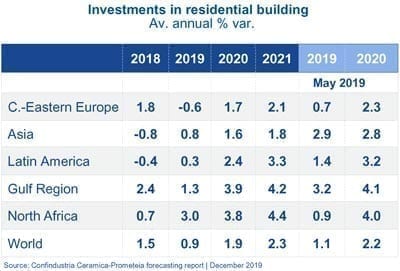

Latin America is also seeing a renewed upswing driven by the recovery in Brazil, although downside investment risks persist due to weak foreign demand, sluggish economic reform and a renewed contraction in GDP forecasts for Argentina. The civil engineering sector is expected to be fairly dynamic, the residential sector less so. However, the ongoing difficulties encountered by Italian companies attempting to enter this market will continue in 2020-2021.

The outlook for construction in the Gulf region remains more positive due to the increased investment in Saudi Arabia, although the Emirates market is becoming less dynamic as the positive effects of the Dubai Expo gradually fade. Tile consumption will be boosted both by the completion of new infrastructure projects and by the growth of the residential market and is expected to resume its expansion at a CAGR of over 3% in 2020-2021. Investments in construction are also picking up slowly in Israel, Morocco and Tunisia, especially in the Israeli residential sector, although the increase remains modest in terms of growth rate volumes. By contrast, the start of reconstruction activities in Libya continues to be mired in uncertainty.

The outlook for construction in the Gulf region remains more positive due to the increased investment in Saudi Arabia, although the Emirates market is becoming less dynamic as the positive effects of the Dubai Expo gradually fade. Tile consumption will be boosted both by the completion of new infrastructure projects and by the growth of the residential market and is expected to resume its expansion at a CAGR of over 3% in 2020-2021. Investments in construction are also picking up slowly in Israel, Morocco and Tunisia, especially in the Israeli residential sector, although the increase remains modest in terms of growth rate volumes. By contrast, the start of reconstruction activities in Libya continues to be mired in uncertainty.

Chinese residential construction continues to slow, although government intervention will enable the sector to avoid a hard landing by easing restrictions on the real estate market. The prospects for civil engineering are more favourable following the approval of a new infrastructure investment plan, while the Chinese market is expected to expand at a CAGR of 1.5% in 2020-2021. It is not yet clear how the coronavirus outbreak will affect market forecasts.

New infrastructure investment programmes are also planned for India, where civil engineering continues to be the most dynamic sector, while the credit crisis is impacting investment in residential construction. No significant developments are expected in the Far East: the recovery of the South Korean market (+2.8% CAGR in 2020-2021) will be offset by continued underperformance of Japan due to the lack of growth in residential construction investments.

Western Europe is expected to see a slowdown in its macroeconomic scenario due to low household consumption and above all low levels of business investment. The Spanish, French and German markets are expected to maintain an expansive, albeit gradually decelerating, profile. The expectations of a slowdown have been confirmed in the UK residential sector, which has been hit by the process of leaving the EU and signs of declining property prices. No substantial recovery is expected in the Greek market, where Turkish, Spanish and Indian companies will continue to enjoy the strongest growth potential. Demand for tiles in the Balkan region is expected to continue the upward trajectory that has been observed for the past five years. Up to 20 million square metres of Italian-made tiles may be exported to the region in 2021, the biggest markets being Croatia, Slovenia and Bulgaria.

The upward trend in Italy’s construction industry is expected to gain further momentum in 2020-2021, particularly in the new building sector, although at a more moderate pace than in the previous two years and mitigated by the slowdown in the renovation segment.

February 2020