Weak and uneven recovery for construction in Europe

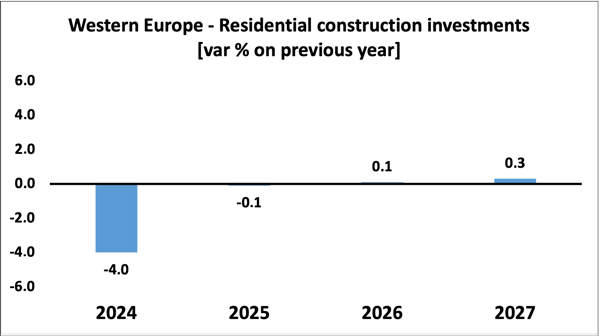

(December 2025) | The European construction market remained fragile in 2024-2025, with widely diverging trends across the various countries in the region. Western Europe continues to feel the impact of the weak German economy and the political instability in France, while construction demand is still constrained by high interest rates, which have only recently begun to stabilise.

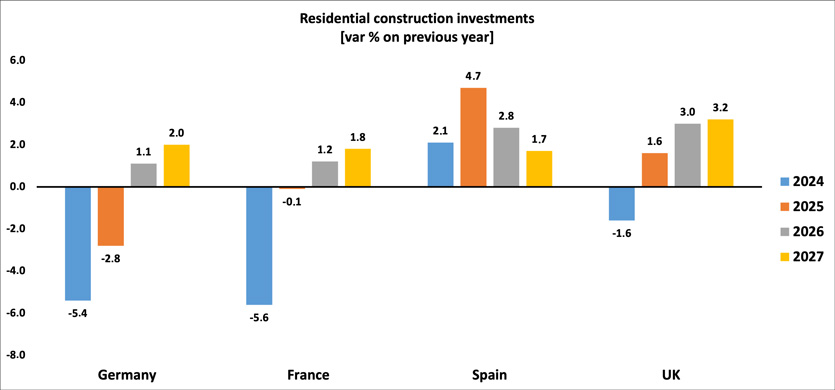

In Germany, the residential market has been contracting for more than two years. Investment fell by more than 5% in 2024 and is expected to remain in negative territory in 2025 (-2.8%). Nonetheless, the first signs of stabilisation are emerging: the decline in building permits is slowing and construction firms are seeing a moderately positive trend in orders across all segments, including residential. House prices are rising more slowly than household incomes, resulting in a gradual improvement in affordability. The outlook for 2026-2027 points to a moderate recovery, driven by a rebound in building permits and a structural housing shortage.

In Germany, the residential market has been contracting for more than two years. Investment fell by more than 5% in 2024 and is expected to remain in negative territory in 2025 (-2.8%). Nonetheless, the first signs of stabilisation are emerging: the decline in building permits is slowing and construction firms are seeing a moderately positive trend in orders across all segments, including residential. House prices are rising more slowly than household incomes, resulting in a gradual improvement in affordability. The outlook for 2026-2027 points to a moderate recovery, driven by a rebound in building permits and a structural housing shortage.

France is likewise emerging from the severe downturn of 2023-2024, with residential investment falling in 2024 (-5.6%) and remaining stagnant in 2025 (-0.1%). However, the 2025 figures for permits and new housing starts suggest that the decline has bottomed out, with tentative signs of a recovery in new residential construction, albeit still below pre-crisis levels. Prospects for investment in renovation appear more robust. As in Germany, more moderate house price growth compared with incomes may help improve access to the property market, with forecasts pointing to a cautious recovery in construction investment from next year.

In the United Kingdom, 2024 ended with a smaller contraction than in Germany and France (around -1.6%), and the market is expected to return to modest growth in 2025 (+1.6%). The recovery is being driven by housing demand linked to demographic factors and by public investment in social housing, although the overall context continues to be marked by uncertainty over fiscal policy. Growth is expected to accelerate in 2026-2027, with average annual increases of around 3%.

Spain has been the most dynamic of the major European markets over the past two years. Residential investment grew by 2.1% in 2024, while the projected expansion of just under 5% in 2025 is among the strongest in the region. The positive cycle is driven by tourism, immigration and relatively favourable macroeconomic conditions. At the same time, however, the rapid rise in house prices is creating mounting affordability pressures. A slowdown is expected in 2026-2027, although activity levels are likely to remain above the European average.

In the current highly uncertain climate, these differing national cycles are likely to translate into a phase of consolidation for construction investment in Western Europe as a whole, with only modest overall growth expected over the next two years.