The pace of logistics real estate investments slows

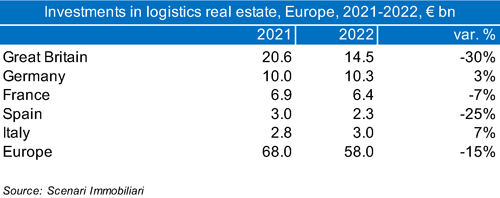

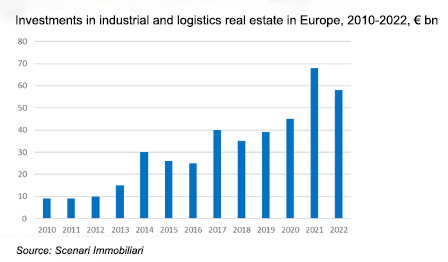

In marked contrast to the slowdown affecting the European logistics real estate market as a whole (investments dropped to €58 billion in 2022), the Italian market is continuing to see rapid growth driven by foreign investments and online sales. The two new watchwords are innovation and sustainability.

This in short is the situation in the logistics real estate market in 2022, with Italy in the forefront in terms of investments and Milan the sector’s star performer, although the rate of growth appears to be slowing in 2023. In 2022, Italy maintained its position as Europe’s fastest growing market with a 7% uptick in investments to a total volume of more than €3 billion, compared to a Europe-wide contraction of 15% with respect to 2021.

These are just a few of the figures that emerge from the “2023 Report on the logistics real estate market” published by Scenari Immobiliari in cooperation with SFRE, a project and construction management company specialising in logistics and light industrial real estate. According to figures released by Savills, Milan climbed to 5th place in the ranking of European cities attracting the highest volume of real estate investment in 2022, driven mainly by the office and residential sectors. The top four European cities were London, Paris, Berlin and Stockholm. Dublin followed in sixth place, then Brussels, Oslo, Helsinki and in tenth place Madrid.

The biggest news in the global market was the recent launch by US giant Blackstone of the $30 billion global real estate fund Blackstone Real Estate Partners X, considered the largest real estate fund ever launched by a US investment management company. The organisation will also operate in Europe and Italy with logistics, offices, hospitality and residential as its target assets. In Europe, Blackstone has already launched six funds, the latest of which was the €9.8 billion Blackstone Real Estate Partners Europe VI in 2020, while fund number 7 is in the pipeline. Blackstone was a major player in the Italian market in 2022 with the country’s largest ever acquisition of a real estate company: the €1.2 billion purchase of Reale Compagnia Italiana, which owns 14 premium properties in Milan and one in Turin, including the iconic Via Montenapoleone 8 building and the Galleria Subalpina shopping centre.

However, according to analysis by Dils Real Estate, the rate of growth in Italy slowed in the first quarter of 2023. The logistics segment accounted for real estate investments of €258 million out of a total volume of around €1 billion (27% of the total), a 17% reduction compared to the last quarter of 2022. In addition, a logistics space take-up of 626,000 square metres was recorded in the first quarter of 2023, down 12% compared to the same quarter in 2022. At the same time, prime rents continued their upward trend in the main markets in the first three months of the year, according to data from Dils. The highest rents were recorded in Rome and Milan (63 €/sqm/year), but increases were also seen in Bologna (60 €/sqm/year), Piacenza (54 €/sqm/year) and Turin (50 €/sqm/year). Recent 2023 surveys by the in-house research department of WCG (World Capital Group) show that logistics and offices are the highest performing commercial asset classes. Logistics remained the most attractive and most popular asset class among investors in the first three months of 2023. The logistics market remains safe and stable, with rents generally increasing compared to the first half of 2022 (Milan +3.3%, Rome +2.4%, Piacenza +8.1% and Bologna +9.1%).

The average size of warehouses followed an upward trajectory in the first three months of 2023, with 66% of the take-up volume deriving from assets larger than 20,000 square metres. “In the early months of 2023, the market witnessed the development of warehouses larger than 50,000 square metres, as in the case of three of the six warehouses that GLP is about to build in Italy,” explains Marco Belli, Country Director Italy for GLP. “Milan tops the rankings in terms of volume (37%), followed by the Veneto region (11%), Rome (11%) and Bologna (7%), although as of this year the institutional logistics frontier is moving southwards through the Italian peninsula towards markets where demand is growing such as the Campania and Apulia regions.”

Returning to the research conducted by Scenari Immobiliari, “the national logistics real estate market is solid and mature, but its future depends on the choices that will be made in terms of innovation, design and technology over the next few years”, explains Francesca Zirnstein, general manager of Scenari Immobiliari. “In addition, space is considered more crucial than in the past to enable warehouses to hold adequate stock to cope with further disruptions in the supply process, to mitigate the impact of rising costs, and to contribute to the speed of response to demand.”

June 2023